The stock market took a pounding in the first half of 2022. It’s now making new lows since Fed Chairman Jerome Powell’s decision to raise interest rates more aggressively, leaving stocks with sobering year-to-date losses ranging from 14% for the Dow Jones to 18.5% for the S&P 500 and 27% for the tech-heavy Nasdaq.

X

But the stock market forecast for the next six months holds glimmers of hope. While the U.S. economy is showing signs of weakness and the global economic and geopolitical picture is gloomy, stocks have a chance of staging a stunning fightback.

Many factors are at play, and investors must be ready to protect themselves in what is sure to be a choppy and volatile market. With the risk of a recession rising, things could get worse for the stock market before they get better.

The Dow Jones Industrial Average and other major indexes have been smacked down badly so far in 2022. A number of attempted rallies raised hopes that the pain would end. In fact, the IBD market outlook switched to “confirmed uptrend” four times amid rally attempts, but each time they petered out.

“The year thus far has seen a market that has struggled to price in some worst-case scenarios as it pertains to both inflation and monetary policy,” National Securities Chief Market Strategist Art Hogan said.

The major stock indexes aren’t the only ones that have struggled. Small caps have been slaughtered, with the Russell 2000 sinking 22%. The Innovator IBD 50 ETF (FFTY), a key gauge for growth stocks, has plummeted 40.5%.

Why Stock Market Could Rally In Next Six Months

From a historical basis, time is on the side of the stock market. CFRA Chief Investment Strategist Sam Stovall cites a clear precedent for the stock market retracing its losses.

“In 2021 we had a price increase in excess of 20%,” Stovall noted. “And in each of the 20 years since World War II in which we had a calendar year gain of 20% or more, the market then fell into a decline averaging around 11%. Most times the decline started in the first quarter. That’s exactly what we’ve got this time round.

“If there is a silver lining to that historical data,” he said, “it is that any of the observations where the decline has started in the first half of the year, we got back to break-even by the end of the year every time.”

Stovall acknowledges that this year’s deep drop makes recouping all losses harder to achieve.

But Hogan believes we’re closer to the end of the stock market sell-off than the beginning.

“The S&P 500 can certainly end the year higher,” he said. “I think we’ve done a pretty efficient job of pricing in some of the worst-case scenarios that we’re worried about that may well not come to fruition.”

He sees three catalysts that could propel stocks back from their lows: an end to the Ukraine-Russia conflict, China reopening in earnest from its “zero Covid” lockdowns, and inflation burning itself out.

Hogan currently has a year-end target for the S&P 500 of 4800, which would be a return of around 30% from current levels.

He holds out less hope for the Nasdaq. Though he thinks it could make up some lost ground, he believes it will end 2022 with a decline in the “high single, low double-digits.”

Oanda senior market analyst Edward Moya also thinks equities will clamber off the canvas before the end of the year.

“U.S. equities should get their groove back before the end of the year as Wall Street will soon start to fully price in Fed tightening. The S&P 500 might struggle as service spending will outpace purchases for goods, but it should recover a good portion of this year’s decline,” he said. “The Nasdaq will likely see a big rebound led by the megacap giants. The Nasdaq is down over 30% on the year and it could recover around half of that decline.”

Factors Affecting Stock Forecast For Next Six Months

But history is an imperfect guide. Today’s challenging conditions could grow even worse if the economy falls into a recession, which is now more likely as the Fed moves to raise rates in a more aggressive manner than before.

Also, the second year of President Joe Biden’s term comes with worrying historical baggage. Since the Second World War, year two of a presidency brought below-average stock market returns of around 5%, Stovall says. This compares to an average gain of 9.2% in all years since then.

“We are getting the decline as history said we would,” he said. “We’re getting the increased volatility. Now the question is whether the market has factored in all of the worries about the Fed and so forth with its peak-to-trough decline or could there be more ahead. I’m of the mindset that there will likely be more ahead.”

David Ryan, a former hedge fund manager and protege of IBD founder William J. O’Neil, is also in the camp that sees continued struggles ahead in the stock market forecast for the next six months. He points out that bear markets usually have three legs down before rebounding.

“I expect at least another move down in the second half of the year, and then maybe when we get into October that will be, from the top of the S&P 500 … about nine months,” he said. “A lot of the time bear markets, shorter ones, last nine months. Longer ones will keep on going for about a year and a half.”

He also notes that it’s getting harder and harder to find pockets of strength.

“I think it’s going to continue to be tough just because we’re almost running out of (industry) groups,” he said. “We need to get some new fresh names, new fresh groups acting well. It’s really been a lot of the same groups running, especially since the beginning of the year. You look at the industry group ranks and it is all oil and gas related.”

Inflation And Stock Market Forecast

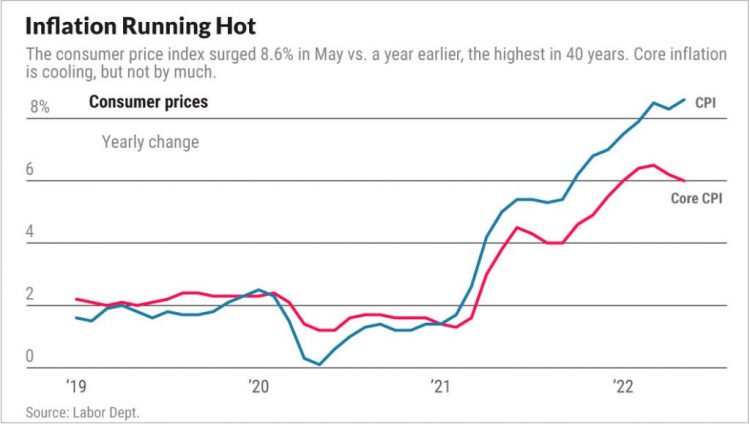

Some investors may fear that the current predicament is similar to that suffered in the 1970s, when Federal Reserve Chairman Paul Volcker unleashed enormous interest rate hikes to quell runaway inflation.

The federal funds rate reached a peak of 20% in June 1981. While this induced a recession, it also tamed inflation and ushered in an unprecedented era of economic growth.

Inflation had been running in double digits for nine years when Volcker took the helm. The U.S. also was coming through crises, including two oil embargoes and price control measures invoked by the Nixon administration. In contrast, current spiraling inflation is relatively short-lived.

“Paul Volcker really had a massive job on his hands and rose the fed funds rate to 20% to kill what at the time was 14% inflation. If that sounds like today, I’m looking at the wrong data,” Hogan said.

He points out Volcker would raise rates 2.5% at a stroke, and the first anyone would learn about it was when banks raised their rates in concert the following day. Nowadays investors are blessed with a plethora of information including Fed minutes, senior bank officials speaking to the media and post-meeting news conferences.

“Nobody has to guess what our Fed is doing and what they’re thinking about,” Hogan said.

What Investors Should Do In The Bear Market

So with all the risks hanging over the stock market forecast for the next six months, what should investors do? Cash is often seen as dead money. At the same time, protecting one’s capital by shielding it from vicious drawdowns is the hallmark of the exceptional stock market investor.

Ryan, who is a three-time U.S. Investing Championship winner, said he is currently mostly in cash.

“It’s not a time to be taking a tremendous amount of risk and to be 100% invested. Investors have to be extremely selective on where they go,” he said. “I would be very defensive and hold onto cash and wait it out.”

Other Steps Stock Market Investors Can Take Now

While it is easy to switch off and focus on other things when stocks are struggling, it can actually be the best time to turn yourself into a better investor.

“When it’s hard to make progress in the market, this is a great time to study what you did in the prior market,” Ryan said. “Learn from your mistakes, go back over the last year and a half and see where you made your money, where you lost your money and you’ll learn more about where you do well in the market from studying your own mistakes than listening to anyone else.”

He recommends that you study when you bought stocks, where you sold them and where you took the losses that are inevitable for the active investor. Eventually you should see patterns emerge.

He also says another thing investors can do in a bear market is to build a robust watchlist of stocks that are displaying relative strength. These are the stocks that aren’t falling as much as the overall stock market or are even eking out a few gains. The watchlist can prepare you to snap up new leaders when the next market uptrend begins.

Tech Stocks Could Hold Key To Stock Market Forecast For Next 6 Months

So far in 2022, formerly highflying stocks have been obliterated. The Invesco S&P 500 Equal Weight Technology ETF (RYT) has fallen by 24% for the year.

The ARK Innovation ETF (ARKK), a proxy for riskier, speculative tech, has plunged about 53% this year. It’s more than 70% off the all-time highs it reached in February 2021.

Wells Fargo Investment Institute President Darrell Cronk believes the stock market’s fortunes hinge on technology fighting its way out of its current malaise.

“If you use the S&P as your proxy you cannot mathematically get back to those highs if you don’t get a major participation of technology,” Cronk said. “Tech is still not just the largest sector, but it’s equivalent to the bottom five to six sectors mathematically on the index. If you don’t get tech to participate, you’re going to have a difficult time pushing back to old highs or setting new all-time highs.”

Looking at the stock market forecast for the next six months, Cronk believes the S&P is most likely to rebound somewhat and end the year around the 4,200 to 4,400 level, or up about 13.5%-19% on June 17’s levels. This would leave it well below the all-time high of 4,818 reached in January.

For her part, Ark Invest chief Cathie Wood has said she believes the market is near a bottom and that tech stocks will be the first to recover.

Interest Rate Hike Impact On Stocks

Arguably the biggest factor causing so much destruction in the markets is the policy pivot by the Federal Reserve as it aims to tackle inflation.

Federal Reserve Chairman Jerome Powell underlined a newfound resolve to attack inflation as he unveiled a 75 basis point interest rate increase at this month’s Fed meeting. He also indicated an equally large hike could be coming next month.

Wincrest Capital CEO Barbara-Ann Bernard believes investors should be cautious given the Federal Reserve’s move to finally tame inflation.

“In our industry there’s the whole mantra of don’t fight the Fed, and I don’t think you should here,” she said. “They’ve been very clear that the narrative here is no longer transitory, that they’re going to front-load hikes and this is what the market is finally pricing in.”

Powell has said efforts to tame inflation could cause “some pain” as bankers attempt to achieve a “softish landing.” The aim is to achieve a cyclical slowdown in economic growth while only suffering a brief recession, or none at all.

Powell has conceded the economy could see the unemployment rate rise “a few ticks.” But many economists worry that a more severe recession could be in the cards.

Recession Risk And Stock Market Impact

CEOs ranging from Jamie Dimon at JPMorgan Chase (JPM) to Elon Musk of Tesla (TSLA) have issued stark warnings about the economy.

Dimon used the most colorful language of all when he pivoted from a cautiously upbeat outlook to predicting “a hurricane” in the space of a few weeks.

Wells Fargo Investment Institute’s Cronk told Investor’s Business Daily that the bank’s economists now expect a recession to kick off by the end of the year.

“We think the second half of the year is going to be pretty choppy. In fact our base case is that probably in Q4 of this year and going into Q1 and Q2 of next year, the U.S. economy experiences a mild recession on the back of what is transpiring with monetary policy, tightening financial conditions, deteriorating consumer and business confidence, increasing cost structures and inflation.”

This is far from an outlying view. A majority of economists polled by the Financial Times are expecting a recession, with the main question being the timing. In total, 38% are predicting it will occur in Q1 or Q2 of 2023 with a further 30% seeing it kicking off in Q3 or Q4 of next year.

Why The Stock Market Can Bounce Back Amid A Recession

The stock market tends to look six to 12 months ahead in terms of valuation, which means it acts as a forward indicator.

Hogan believes inflation’s impact on the stock market already has been significantly priced in by investors.

“By the time we declare a recession, which is typically in the middle rather than the beginning of it, the recession is well along its way,” he said. “If we declare a recession, is it going to surprise anyone that’s been trading equities over the course of the last 24 months? No, that’s the number one concern investors have had.”

Further, stocks already have made a significant contraction that is not obvious when looking at the indexes themselves.

“The average stock on the S&P 500 from its recent high is down 30%. The average stock on the Nasdaq composite is down 48%. So I think, again, we’ve priced in some worst-case scenarios that might not come to fruition,” he said.

CFRA’s Stovall said a normalization of inflation could encourage investors to dial up exposure.

“The market could experience a relief rally if investors start to convince themselves that the Fed may need to dial back their aggressiveness,” he said.

Consumer’s Role In Recession Impact On Stock Market

One of the key drivers for the U.S. economy is consumer spending, which accounts for roughly 70% of all economic growth.

But Bernard, who is portfolio manager for the Wincrest Contraria Fund, thinks the U.S. consumer is weaker than is widely recognized.

“We are short the discretionary consumer. It’s a high conviction idea,” she said. “2021 is not a ‘comparable’ year for retail in 2022. Multiples have contracted, but EPS expectations have not yet, and they need to, particularly in the face of so many headwinds, such as no more stimulus checks, highest inflation in 40 years impacting margins, higher mortgage rates and a preference for returning to experiences such as travel over buying another barbecue or on-demand streaming TV subscriptions.”

Wells Fargo’s Cronk agrees.

“We do see signs of weakening in the consumer. If you look at consumer confidence we’re back below where we were in parts of 2008-2009 on confidence sentiment numbers, so the consumer is concerned,” he said. “The question will be, if the consumer is 70% of the U.S. economy and the big engine that drives growth, if (they) were to lose confidence and back away from spending, that could be a challenge for growth numbers.”

Ukraine Is A Wildcard For Stock Market Forecast For Next 6 Months

Energy stocks and fertilizer plays rallied after Russia invaded Ukraine. In contrast, other stocks plummeted amid the rising uncertainty.

“The war in Ukraine was one of those exogenous factors that took inflation to the next level and led to another de-risking moment in Wall Street,” Oanda’s Moya said.

At the moment, no clear end is in sight for the conflict, which has dragged on almost four months.

Fertilizer stocks and energy plays were significantly boosted. But both have sold off also. With the West trying to cut off Russian oil and gas imports, further gains are possible.

Energy Stocks May Have Room To Run

Oil stocks and natural gas stocks have put in strong outperformance in 2022. The Vanguard Energy Index Fund (VDE) is up about 30% despite selling off the past week.

Some individual stocks have fared even better. Examples include IBD 50 name Matador Resources (MTDR) and Ranger Oil (ROCC), but both weakened sharply the past week.

Even oil major Exxon Mobil (XOM) has turned in a performance that would put some growth stocks of years gone by to shame. It vaulted as much as 75% before paring gains.

“Some oil companies will be profitable at 40 or 60 dollars per barrel. We’re almost at 120. They have a good outlook,” Moya said. “Oil prices will remain elevated for not just this year, but the next several because of a lack of investment in big wells and the transition to green energy struggles.”

But Ryan believes energy stocks may need to pull back to stop them from overheating.

“Some of them have been going up for almost 18 months, and just in the last couple of weeks, some had been starting to go almost straight up,” he said. “The oil and gas move might be getting late.”

China Lockdown And Supply Chain Woes

China’s sweeping “zero Covid” policy is disrupting supply chains, which were already having difficulties. And while the country shows sign of easing its sweeping lockdown measures, a bumpy road may lie ahead.

China is already walking back some of the loosening, with Beijing delaying the reopening of schools amid a new outbreak and Shanghai suspending dine-in services at restaurants.

Nicholas Burns, the American envoy in Beijing, has said the policy could drag out into the “beginning months of 2023.”

Nevertheless, Chinese exports grew at a double-digit pace in May and came in ahead of forecasts. If the country continues to ramp up its exports, it would be a major catalyst for stocks as supply chains ease.

Stock Market Forecast Next 6 Months: Bargain Hunters Beware

Many investors will be tempted to use the current severe stock price drops as an excuse to go bottom fishing for “bargains.”

Many of the highest-flying growth stocks, which had been valued on a revenue growth rather than earnings basis, suffered drawdowns of 80% or more.

But bottom fishing comes with clear dangers. Just because a stock has suffered a precipitous decline does not mean it won’t carry on its losing streak.

IBD’s O’Neil warned that individual investors can be sucked in as they look for bargains only to be left nursing painful losses.

“Many institutional investors love to ‘bottom fish.’ They’ll start buying stocks off a supposed bottom and help make the rally convincing enough to draw you in,” O’Neil wrote in “How To Make Money in Stocks.” “You’re better off staying on the sidelines in cash until a new bull market really starts.”

Please follow Michael Larkin on Twitter at @IBD_MLarkin for more on growth stocks and analysis.

YOU MIGHT ALSO LIKE:

MarketSmith: Research, Charts, Data And Coaching All In One Place

These Are The 5 Best Stocks To Buy And Watch Now

This Is The Ultimate Warren Buffett Stock, But Should You Buy It?

Software Growth Stocks To Buy, Watch Or Sell

This Is The Ultimate Donald Trump Stock: Is DWAC A Buy?

Source by www.investors.com