Zee Business Stock, Trading Guide: The domestic markets started the week on a robust note and gained over a percent, tracking firm global cues. After the gap-up start, the Nifty hovered in a narrow range for most of the day and buying in the last hour helped it to reclaim 18,000 levels.

The buoyancy in the global markets, especially the US, combined with favourable domestic cues is helping the markets to maintain the prevailing recovery, Ajit Mishra, VP – Research, Religare Broking said in his post markets comment on Monday.

Mishra expects the Nifty to regain momentum above the 18,100 level, adding that the participants should look for buying opportunities on every dip and avoid contrarian trades in line with the trend.

Here is a list of things to watch out for on 01 November 2022

Key support & resistance levels for Nifty50:

The Nifty50 closed 0.28 per cent higher at 17,786.8. Key Pivot points (Fibonacci) support for the index is placed at 17931.35, 17902.35, and 17855.4, while resistance is placed at 18025.25, 18054.25, and 18101.2.

Key support & resistance levels for Nifty Bank:

The Nifty Bank closed 0.75 per cent higher at 40,990.85. Key Pivot points (Fibonacci) support for the index is placed at 41161.32, 41102.88 and 41008.3, while resistance is placed at 41350.48, 41408.91, and 41503.5.

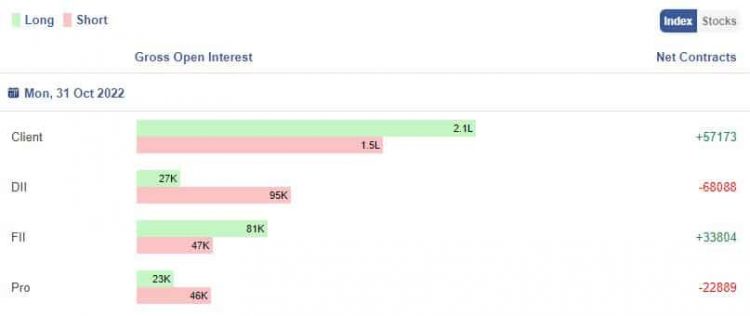

Gross Open Interest:

Open Interest means the number of contracts open or outstanding in futures trading in NSE at any one time. One seller and one buyer together create one contract.

Here the gross values of Open Interest Positions taken by the four participants namely Client are Clients are the retail individual investors who invest in the derivatives instruments, DIIs are domestic individual investors, FIIs are foreign institutional investors and Pro are the proprietors and brokerage firms who trade on their own behalf.

Image Source – Stockedge

Stocks in News:

MOIL: Prices of Ferro grades of manganese ore with Manganese content of Mn-44% & above cut by 7.5%

Cupid gets Rs 3.72 crore order from United Nations Population Fund UNFPA.

Axis Bank: Bain Capital to sell 1.24% stake in Axis Bank via Block Deals on November 1, 2022.

India Glycols: DGTR recommends an end to anti-dumping probe on Mono-Ethylene Glycol (MEG) imports from USA, Saudi Arabia, Kuwait

Hindustan Aeronautics Limited (HAL) gives additional charge for the post of Chairman & MD to CB Ananthakrishnan, Director (Finance).

HFCL gets approval for application under production-linked incentive (PLI) scheme, to avail of incentives up to Rs 652.79 crore.

Bharti Airtel: Airtel pays Rs 8,312 crores for 5G spectrum to DoT for 4 years – settled ahead of schedule to free up cash flow for 5G rollout.

L&T: Management says looking to completely exit road assets, likely to sign an agreement this quarter for complete #divestment.

Q2 Earnings

Tata Steel reports Q2 earnings: Net profit slumps almost 90% from the same quarter last year and material costs rise sharply, up nearly 30% YoY

Bharti Airtel reports Q2 earnings: Margin at 51% versus 50.4% QoQ (quarter-on-quarter) and mobile services India revenues up 24.8% (YoY)

Equitas SFB Bank Q2 earnings: Net profit at Rs 116.4 crore versus Rs 41.2 crore YoY (Year-on-Year) and NII (net interest income) up 26 per cent at Rs 609.7 crore versus Rs 484 crore YoY.

Timken India reports Q2 earnings: Net profit up 23.3% at Rs 97.6 crore versus Rs 79.2 crore YoY and revenue up 24.6% at Rs 695.4 crore versus Rs 557.9 crore YoY.

Castrol India reports Q2 earnings: Net profit up 0.7% at Rs 187.2 cr versus Rs 186 cr YoY and revenue up 4.5% at Rs 1,121.1 crore versus Rs 1,073.2 crore YoY.

FII Activity on Monday:

Foreign portfolio investors (FPIs) remained net buyers for Rs 4,178.61 crore in the Indian markets while Domestic Institutional Investors (DIIs) were net sellers to the tune of Rs 1,107.10 crore, provisional data showed on the NSE.

FII Index and Stock F&O:

Image Source – Stockedge

Bulk Deals:

Maks Energy Sol India Ltd: Vinod Somani HUF bought 36,000 equity shares in the company at the weighted average price Rs 43.53 per share on the NSE, the bulk deals data showed.

Nandani Creation Limited: L7 Hitech Private Limited sold 1,50,000 equity shares in the company at the weighted average price Rs 78 per share on the NSE, the bulk deals data showed.

Tourism Finance Corp: Rajasthan Global Securities Pvt Ltd bought 6,70,958 equity shares in the company at the weighted average price Rs 82.69 per share on the NSE, the bulk deals data showed.

Stocks under F&O ban on NSE

No stock was placed under the F&O ban for Tuesday. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Source by www.zeebiz.com