Text size

Marvell, which sells a variety of chips and hardware products, forecast slightly better-than-expected revenue for the current quarter.

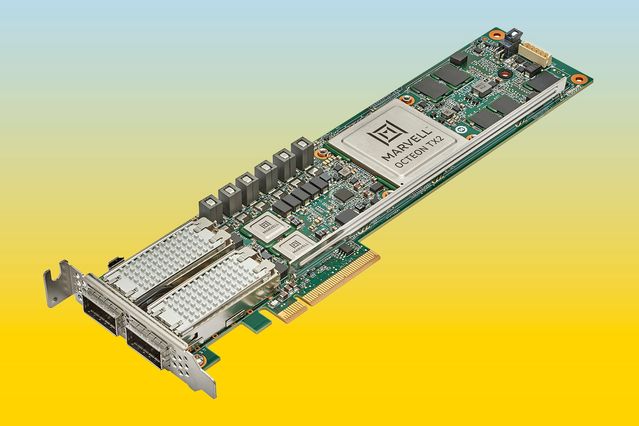

Courtesy of Marvell Technologies

Marvell Technology

shares climbed after it posted solid earnings results and gave guidance slightly above Wall Street expectations.

The semiconductor firm reported adjusted earnings per share of 52 cents for the April quarter, compared with the consensus estimate of 51 cents among Wall Street analysts tracked by FactSet. Revenue came in at $1.447 billion, which was above analysts’ expectations of $1.427 billion.

Management’s financial outlook was solid as well.

Marvell

(ticker: MRVL) forecast a range of potential revenue for the current quarter with a midpoint of $1.515 billion, compared with the consensus view that revenue will be $1.489 billion.

The company shares, which initially fluctuated in late trading after the earnings release, later rose by 6.7% to $60.80.

Marvell sells a portfolio of chips and hardware products for the data center, 5G infrastructure, networking and storage markets.

On the conference call, the company’s managers said they were confident about demand from their customers, noting nearly 90% of their revenue came from data-infrastructure projects—not the consumer.

Wall Street analysts have been generally positive on Marvell. About 90% have ratings of Buy or the equivalent, while 9% have Hold ratings on the shares, according to FactSet.

Early this week, Susquehanna analyst Christopher Rolland reaffirmed his Positive rating for Marvell, saying he is confident in the long-term performance of the company, citing its strong management team.

The company’s shares have declined by 35% this year, compared with the 24% drop for the

iShares Semiconductor ETF

(SOXX), which tracks the performance of the ICE Semiconductor Index.

Write to Tae Kim at tae.kim@barrons.com

Source by www.barrons.com