(Bloomberg) — China urged some of the country’s biggest investors to buy more stocks, stepping up efforts to stem the market’s slide toward a two-year low.

Most Read from Bloomberg

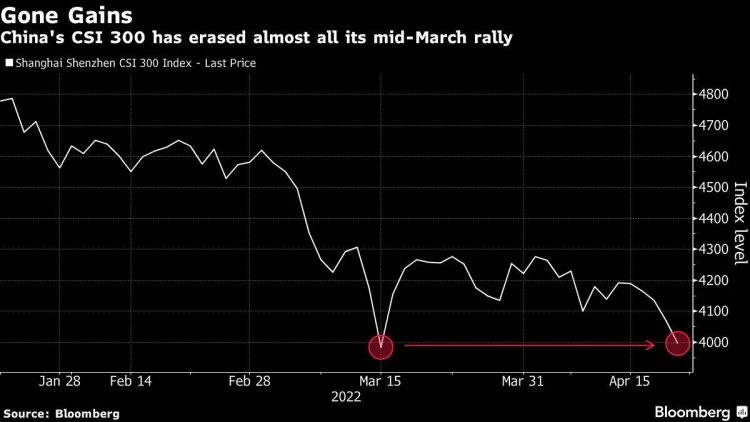

The nation’s securities regulator issued the guidance at a Thursday meeting with investors including the country’s giant social security fund, just as the benchmark CSI 300 Index was sinking toward the lowest level since June 2020. The gauge was little changed on Friday after erasing a drop of as much as 1.1%.

Chinese equities have lost about $2.7 trillion of market value this year as the nation’s strict Covid Zero policies, corporate crackdowns and slowing economic growth spooked investors. While a government committee led by Vice Premier Liu He issued a sweeping set of policy promises to stabilize markets in mid-March, investors have so far been disappointed by a lack of follow-through.

“For a turnaround in sentiment, we need to see something sincere from policy makers, either a lot of extra liquidity, a major shift in the Shanghai situation, or a massive surprise that will breathe some new hope into the market,” said Wang Yugang, a fund manager at Beijing Axe Asset Management Co. “Even in a critical year like this, a robust stock market has quite a low priority because currently there’s no systemic risk.”

The Thursday meeting convened by the China Securities Regulatory Commission was followed by a series of articles in state media projecting confidence in the economy and markets. The concerted efforts underscore growing pressure on authorities to boost confidence before a closely watched leadership confab that’s expected to confirm a precedent-breaking third term for Chinese President Xi Jinping.

Story continues

Other Chinese assets have also been under pressure. The onshore yuan is on track for its biggest weekly loss since August 2019, as concerns mount about slowing economic growth amid Covid lockdowns.

“The PBOC is looking to provide further support for the economy, and seems intent on pulling as many levers as possible, perhaps with the exception of lowering interest rates for now,” said Khoon Goh, head of Asia research at Australia & New Zealand Banking Group Ltd. “Allowing the yuan to weaken slightly this week seems to be part of the overall ‘support package.’”

The nation’s high-yield dollar bonds also declined for a second straight week in the worst such stretch since mid-March. That pares an initial bounce that the securities got from Beijing’s promises, as investor patience for more details wears thin.

In a sign of broader concerns, higher-rated developers such as Country Garden Holdings Co. have posted some of this week’s largest declines. Any renewed rally ahead may only be sustained if concrete and significant policy steps were taken rapidly, according to Jean-Louis Nakamura, the chief investment officer for the Asia Pacific region at Lombard Odier.

Rapid Outflows

This isn’t the first time the authorities have urged institutional investors to increase positions. A similar call was issued less than two weeks ago following a request made in October 2019.

With no end to tight Covid restrictions in sight, overseas investors pulled a net 5.6 billion yuan ($868 million) from mainland shares this month after offloading 45 billion yuan in March, the largest outflow in nearly two years. Global funds slashed their holdings of Chinese bonds by the most on record in March.

The authorities have shown little alarm about the withdrawals, with Fang Xinghai, the vice chairman of the China Securities Regulatory Commission, saying Thursday that capital outflows will always return.

“Obviously, Beijing wants to stem the bearish sentiment about both the economy and the stock market,” said Castor Pang, head of research at Core Pacific Yamaichi. “But the economy is like a giant ship, and it takes time for it to turn around. Even if Beijing wants to talk up the market, it’s hard to change how investors are thinking.”

Pension Boost

Separately, China also published guidelines on the development of individual pensions on Thursday, which CICC analysts estimate to be valued at a total of 1 trillion yuan in the long term. This may help fuel additional inflows into domestic equities.

Meanwhile, the authorities are trying to resolve a dispute involving the audit of Chinese firms listed in the U.S., an issue which has weighed on sentiment. The securities regulator is holding talks with the U.S. Public Company Accounting Oversight Board every two weeks, and is “confident” about reaching an audit deal, the regulatory commission’s Fang said Thursday.

Hong Kong’s Hang Seng Tech Index slid 0.9% as of the mid-day lunch break, extending its losing streak to four days. Mainland benchmark CSI 300 index rose 0.1%. The gauge has fallen 4.5% this week to head for its worst five-day performance since January.

Still, this week’s drop may be just what’s needed to draw investors back in. Funds have been on the sidelines as they await the market to form a “double bottom,” a sign that it may be safe to build back positions.

(Updates throughout)

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.

Source by finance.yahoo.com