As if wasn’t already tough enough to make a major purchase at a time when living costs are skyrocketing, the interest rates to finance those pricey purchases are going up.

Now consumers are confronting a tough question: Should they pause their searches for new houses, cars and other big-ticket items in the hope that interest rates will fall whenever inflation is reined in?

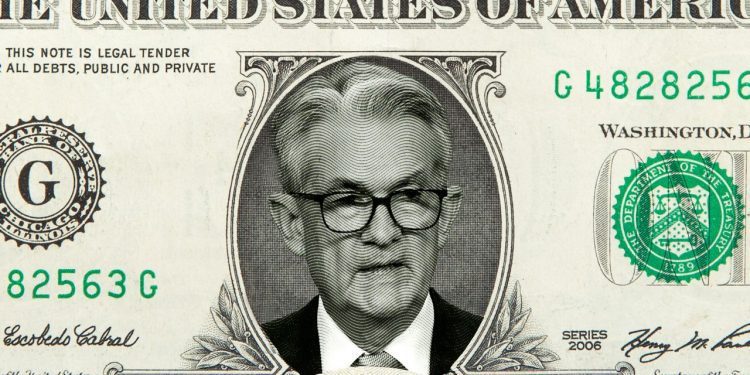

It’s a question that gains urgency with every Federal Reserve meeting about a key interest rate. The central bank announced its latest rate decision Wednesday afternoon, a widely-expected 75-basis point increase that’s the fourth straight hike this year.

Consider the rates people are already staring down.

For a home, a prospective buyer faces a 5.54% rate on a 30-year fixed mortgage, Freddie Mac

FMCC,

-3.72%

said last week. That was up from 2.76% a year ago.

For a new car, five-year auto loans climbed to 4.86% in late July, up from 4.47% in April, according to Bankrate.com.

Even for the everyday goods and services a person puts on their credit card, the rates are climbing.

During the second quarter, annual percentage rates reached 15.13%, up from 14.56% in the first quarter, according to LendingTree. This month, the average rate on all new credit cards is 20.82%, up from 20.17% a month ago.

The Fed on Wednesday signaled still more increases for the federal funds rate, which influences the interest rates lenders charge people buying homes, cars or using a credit card. The Fed had already boosted the federal funds rate three times since March.

Rate cuts could start early next year, according to some Fed watchers — but that’s a guessing game. For right now, it’s the fastest pace of tightening since 1981.

The Fed’s rate hikes are supposed to throw cold water on hot inflation rates, on the theory that steeper borrowing costs slow consumer demand. While the Fed presses on with its plans, some people are deciding whether to press on with their big-ticket spending plans.

It’s a question financial planner Cecil Staton has been increasingly hearing from clients since early this year. “They are getting scared or getting concerned if they are making the right decision,” said Staton, founder of Arch Financial Planning in Athens, Ga.

After questions about stock market turbulence, Staton says the biggest question clients have is whether to move forward or wait on rate-sensitive transactions such as house purchases.

The question on how to proceed in a rising-rate environment is “definitely a bigger question on top of people’s mind that they have to weigh as a potential cost,” said Caleb Pepperday, a wealth advisor at JFS Wealth Advisors, headquartered in Hermitage, Penn.

There are signs that higher costs, including interest rates, are sidelining some potential buyers.

Existing home sales in June missed expectations and marked the fifth straight month of decline. Home price growth in major cities came off record highs in May.

Estimated second quarter new car sales, while up 5.1% from the previous quarter, are down nearly 21% from the year before, according to Edmunds.com.

Meanwhile, three in 10 people were planning to buy a new car this year, but 60% of the would-be buyers were reconsidering or pausing altogether, according to a Quicken survey this month. Two in 10 people were considering a home purchase this year, but roughly 70% called it off. Rising interest rates was one of the factors playing into people’s moving decisions, the survey noted.

A major spending decision is a big choice in any context — let alone at a point when inflation is at a 41-year high and talk continues of a potential recession. Here’s what to consider if you are pausing a search for a new car or home, or speeding up the search to get ahead of even higher rates.

Steps to take if you are pausing a major purchase because of rising interest rates

Consider where to keep down payment money. Anyone looking to halt major spending plans in the next one to three years needs to be extremely conservative about where they sideline cash that’s earmarked for down payments and related expenses, said Zachary Gildehaus, a senior analyst at Edward Jones in St. Louis, Mo. They also need to keep it highly liquid, he noted.

Think high-yield savings accounts or money market funds, he said. If the deferred timeline skews to three years, Gildehaus said people can “sparingly” consider some small investment in short-term, high-quality corporate bonds via a bond mutual fund.

Pay down debts, especially high interest ones. That starts with credit card bills, because the APRs on credit cards are closely tied to Fed action. Carrying balances month to month will get more expensive as rates keep climbing, experts previously told MarketWatch. Of course, avoiding debt is easier said than done when inflation is beating wage increases.

More than two in 10 (22%) of people said they expect to take on credit card debt in the coming six months, according to a recent LendingTree survey. One third of those people have good FICO

FICO,

+1.17%

credit scores ranging from 670 to 739.

Remember your credit score. When lenders determine loan approvals, rates and terms, their calculations incorporate macro-level considerations about interest rates and economic conditions. But they also weigh the creditworthiness of borrowers themselves. High outstanding debts and missed payments can harm a score and dampen a lender’s view.

So can new lines of credit for a major purchase in the lead up to a mortgage, Gildehaus said. It may be tempting for some people to consider substituting things like a car purchase or a loan for a home improvement project for financing for furnishings while they hope for better mortgage rates.

But timing is important, Gildehaus noted. Mortgage lenders extend preapprovals on the applicant’s financial portrait they have in front of them and if that portrait changes in the lead-up to the purchase, they can either change to less favorable terms or potentially deny the application, he said.

Find a way back. Staton leans toward pressing ahead with bigger purchases like a house now, as long as the buyer is financially ready to do so. (By that he means that you currently spend no more than 50% of your income on housing, food and basic needs; 30% on discretionary purchases; and you save 20%, and that on top of that you have the cash to cover a 20% down payment plus closing costs, moving expenses, furnishings and other incidentals, he said.)

But if would-be buyers are pausing, they should latch onto a specific metric, like an interest rate or an income amount, that will serve as a threshold for when they’ll hop back into the search. “You really just have to pick a goal and hold yourself accountable to it. The perfect rate, the perfect house, the perfect time does not exist,” said Staton.

Remember that when you resume the search, it will not be same. Interest rates are one variable, and there’s no guarantee for when and how quickly they will go down, Staton said.

The prices on big-ticket items won’t necessarily be receding either. Housing price appreciation is “unsustainable,” said Steve Rick, chief economist at CUNA Mutual Group, a financial services provider to credit unions and their customers. The growth on prices will slow in the near future, but affordability problems will remain, he said. “While interest rate hikes are putting pressure on consumers, the United States is still facing a housing crisis,” Rick said.

Car prices reflect the same dynamic. In June, the typical monthly payment for a new car hit a record-high $730, according to a Cox Automotive/Moody’s analysis this month that factors interest rates, prices and incentives.

What to know if you are moving ahead on a big purchase in the face of rising interest rates

Don’t rush for emotion’s sake. It may be worthwhile to speed up spending plans to get ahead of even higher rates, and Pepperday has seen that happen. But no matter the economic backdrop, it comes back to separating needs and wants, he said.

“If you have a house or running car now that works, but you ‘want’ to upgrade, it may be worthwhile to wait as rates will likely come down in the future as inflation cools,” he said. If it’s a need, however, it’s important to remove emotion and pinpoint what you can afford to pay.

One way to do that is to calculate the exact monthly mortgage or car payment you can afford, and then draw a bright line there; only consider homes or vehicles up to that amount. In other words, Pepperday said, beware the dangers of getting attached to something you can’t afford and trying to convince yourself you can do it.

Remember the chance for a future refinance. The interest rate homebuyers get on their mortgage now does not have to be the rate they always have, Staton and Pepperday noted. Enter the mortgage refinance. As Staton noted, there’s a saying that circulates in the real-estate banking world: “Marry the house, date the rate.”

If a person can afford to take the jump, he said it’s worth remembering the saying’s gist.

Given where rates are, it’s not surprising to see a lull in refinances after a flurry earlier in the pandemic when rates were at historic lows. In mid-July, one gauge on refinance activity hit a 22-year-low as refinance applications dropped 4% week to week and were 80% lower than a year ago, according to the Mortgage Bankers Association.

On Wednesday morning, before the Fed announcement, the latest mortgage refinance data showed a 4% drop from the previous week and an 83% drop from the same point a year ago.

Source by www.marketwatch.com